Estate Planning, Now as Much as Ever: Estate & Financial Planning Steps You Should Take

Written by: Wills, Trusts, & Estate Administration

With the current coronavirus pandemic, what planning steps should you be taking? From an estate planning attorney’s perspective, it is actually business as usual, but perhaps with an added element of priority. Everyone’s goal right now should be first and foremost the health and safety of ourselves, our family and others, but this pandemic also reminds us of the importance, and in some unfortunate instances, urgency, of a well-planned estate.

As any estate planning attorney will tell you, you should always have an updated Will, power of attorney, and advance directive for health care. But are there other steps you should take? The answer is yes, although they are really the same things we would encourage as part of updating any estate plan.

Let’s run through a brief checklist of what you need to review and consider updating.

1. LAST WILL AND TESTAMENT.

Everyone needs a Will. This is really not an overstatement, whether you own very few assets or have assets worth tens of millions of dollars. Everyone needs a Will. Unfortunately, many do not have a Will, and more unfortunately, there are many misconceptions regarding how your property will pass without one.

A Will makes things easier upon your loved ones after your death. If you do not have a Will, someone must report to the Probate Court and qualify as “Administrator,” post a bond, and report to the court at certain times throughout the administration. Your Administrator must also file an annual accounting with the court, file an inventory with the court, as well as obtain court permission to sell property. In addition, neither you, the Administrator of your estate, nor anyone else will have any discretion over how your property is distributed. It will instead be distributed, in strict accordance with the provisions of state law, to certain relatives in order of their degree of relationship. This is true even if the Administrator knows how you would have wanted your property to be distributed. NO Will = NO control over the disposition of your own assets!

On the other hand, a Will avoids these problems. In executing a Will, you name or appoint the person whom you wish to act as “Executor” in the administration of your estate. Furthermore, a Will generally waives the requirements of your executor posting bond, filing inventory, and otherwise reporting to the court. Finally, you can distribute your property exactly as you want and to whom you wish, down to the smallest knick-knack.

Let’s briefly dispel several common misconceptions about NOT having a Will:

Myth #1. If I don’t have a Will, the State will get my property.

Well, the good news is that this is almost never true. All states have a statute that determines the order of priority of inheritance in the event of intestacy, though it’s not always exactly what you would expect. (More on this in myth #2). Under the laws of most states, your spouse and children would first inherit. And while it varies among states, if you have no spouse or children, then the intestacy laws generally look to your parents, then your siblings, then nieces and nephews, and so on, in some states even out as far as second cousins. Picture a family tree, staying as close in blood relation to ‘your’ branch as you can. Only after you’ve run out of statutory ‘branches’ does your property pass to the state.

Now, that being said, most people do not desire for default state law to govern how their property passes at death. The only way – let me repeat – the ONLY way, that the statutory intestate distribution scheme can be changed is through a Will. Thus, if you die without a Will, it matters not that your loved one(s) knows what you would have wanted done. Your estate must be distributed in that instance in accordance with the statutory scheme.

Myth #2. I don’t need a Will, because my spouse will inherit my property.

While this myth isn’t entirely false, it is most often untrue. For example, in Georgia, if you die with no Will, but with a spouse and children, your spouse receives an equal share with the children, but no less than a 1/3 interest. Thus, if you die leaving a spouse and one child, they split your estate equally. If you die with a spouse and 5 children, your spouse receives 1/3, and your 5 children split the remaining 2/3.

Let’s focus on what is often the big problem here. You may say “I have a husband and 2 small children. I’m fine with each receiving 1/3”. But the problem is this: they each receive a 1/3 undivided interest in your assets. Take, for example, the house that you own. In this instance, your minor children will each be vested with a 1/3 undivided interest in the house. And what if your spouse wants to sell that house and move after your death? In order to do so, the spouse would have to petition the probate court to ask permission to do so on behalf of the minor children, and the court could very well make the spouse segregate the children’s funds into separate accounts, meaning the proceeds might not be rolled over and utilized to purchase a new home.

Even if the court allows it, your children are then entitled to their 1/3 interest outright at age 18. Meaning they could sell their interest in the house. Or prevent the spouse from selling the house outright. This can be a very significant problem, particularly in a second marriage situation where there are children from a prior marriage.

Myth #3. I don’t need a Will, because my house is my main asset and my spouse and I are both on the deed.

This is another one of those that isn’t entirely false. In fact, it may be entirely true. What you have to determine is in what manner was the house held jointly—as Tenants in Common, or as Joint Tenants with Rights of Survivorship? If owned as joint tenants with rights of survivorship, then yes, the house will pass to the spouse at death regardless of whether you have a Will. (In fact, if owned this way, it passes to the spouse even if the Will provides something entirely different). However, if the house is jointly held as Tenants in Common, then it will absolutely not automatically pass. Thus, your ½ interest will pass either in accordance with the terms of your Will, or in accordance with state law for an intestate estate.

Notwithstanding the house, there are almost always other assets that must be administered—a car, a small bank account, a small parcel of land, etc. And this will have to be done through the court in an intestate administration if you have no Will. It is much more cost effective to go ahead and have a Will in place.

Myth #4. I have an old Will that is fine, because I marked some changes on it and initialed it.

Wrong. Once your Will is executed, you may NOT mark on it and make changes. Period. A Will is not like a contract where you can scratch through, write new terms in, and initial it. ANY changes marked on your Will after it is executed will be VOID. They will be given no effect whatsoever. And if your changes are substantial enough, the court may treat you as having revoked your Will, putting you into a situation of intestacy.

Myth #5. I don’t need (or want) a Will because probate is so expensive and such a hassle.

First off, of course, keep in mind that not having a Will doesn’t mean your estate doesn’t have to go through a “probate” process with the court. Further, having a Will almost always makes that process much LESS expensive. Whether you have a Will or not, your estate must be administered through the court in all but the rarest of instances. (The process is called “probate” if you have a Will; otherwise, the process is called an “intestate administration”). For residents of many states, probate is an easy enough process, if you have a valid Last Will and Testament. Indeed, it is far less expensive and far less of a hassle than the problems that can arise from not having a Will and being burdened by the provisions of intestate administration.

Myth #6. I can do my own Will online.

Ok, that’s not false. You can do your own. However, I highly advise that you don’t. And as self-serving as this will surely sound, I will nonetheless say that you generally get what you pay for. I’ve been an estate planning attorney for almost 25 years, and almost every single Will that I have had problems with at probate were Wills that were either do-it-yourself store bought software, online documents, or Wills prepared by attorneys who don’t have a significant estate planning practice. So yes, you can do a Will on your own. You could also give yourself sutures for a bad cut or set your own broken bone. My guess is you would not however. So why take a risk for something as important as disposing of the assets you’ve built over your life or in providing for your loved ones.

2. POWER OF ATTORNEY.

A Power of Attorney, also known as a Financial Power of Attorney, General Power of Attorney or Durable Power of Attorney, is an instrument by which you authorize another person or persons to act on your behalf. This person is known as your “agent” or your “attorney in fact.” This document allows your agent to make financial decisions on your behalf should you become incapacitated, without the need to have the Probate Court appoint a guardian or conservator, which is a time-consuming and expensive process. A Power of Attorney (“POA”) specifically grants your agent the power to handle all financial matters on your behalf.

A Power of Attorney is valid only during your life. It always terminates immediately upon your death and is of no further benefit.

Keep in mind that some duties are not delegable under a Power of Attorney, and are instead personal to the holder or the office the holder occupies, so if you’ve not updated your power of attorney as to the successors listed, you should consider doing so

3. ADVANCE DIRECTIVE FOR HEALTHCARE.

In most states, including Georgia and Alabama, there are two legal documents that protect your right to refuse medical treatment, or to request specific medical treatment, in the event you lose the ability to make decisions for yourself. These documents include the Advance Directive for Health Care (“Advance Directive” or “Durable Power of Attorney for Healthcare”) and a Living Will. In many states, including Georgia and Alabama, these documents have been combined into one form that is now simply called an Advance Directive for Health Care (“ADHC”). A separate stand-alone Living Will is still permissible but is generally not necessary.

Just as with the regular POA, your agent under an ADHC is a person whom you appoint to make decisions about your medical care if you become unable to make those decisions yourself. This agent is often a family member or close friend whom you trust to make these serious decisions. The person you name as your agent should clearly understand your medical wishes and be willing to accept the responsibility of making potential life and death medical decisions for you. As with a regular POA, you can and should also appoint a successor agent should your primary agent become unable to act. An ADHC does not revoke or limit your right to make your own health care decisions, and as long as you are able to express your own wishes, your wishes will control.

4. LIFE INSURANCE, IRA and 401k AND BENEFICIARY DESIGNATIONS.

Beneficiary designation forms seem easy, right? Fill out the form, send it in. These days it’s often easier still—a few keystrokes online and you’re done. In many cases, you accomplish exactly what you think you want.

Unfortunately, these forms and how they are completed can also have unintended, unanticipated, and unfortunate consequences. These risks are often exacerbated by the ease of making online changes, without having ever consulted with your estate planning attorney or financial adviser.

If a life insurance policy has no listed designated beneficiary, then it will pass as part of the probate estate. This is often not a problem—except where the estate is otherwise insolvent and/or has significant creditors. For life insurance (or at least term insurance), if the proceeds are payable pursuant to a beneficiary designation on file, it is not subject to claims of the creditors of the estate or of the decedent. If, on the other hand, there is no beneficiary designation on file, and it is paid to the estate, it is reachable by creditors.

The problem is compounded for qualified retirement plan benefits, as there are also tax consequences. If there is no designated beneficiary, or the beneficiary is the estate (unless very specific language is included in the Will), then all of the retirement accounts must be paid out within 5 years of the date of death, accelerating taxation. If, on the other hand, there is a valid beneficiary designation in place, the retirement assets can either be rolled over (if the spouse is the sole beneficiary), or continue to be paid out over a 10 year period under the SECURE Act, minimizing taxes and allowing for the accrued benefit to continue to grow tax deferred for a little while longer.

Let’s say your Will creates a marital trust for your spouse. Let’s further assume that a significant portion of the funding is intended to be though either your interest in your retirement plan or IRA, or a large insurance policy you own. Yet you failed to heed your attorney’s advice, and the beneficiary designation still provides the spouse is the outright beneficiary. In that event, the asset is a non-probate asset, never passes through the estate, and thus cannot be used to fund the trust your Will intended to create!

Along those lines, a similar problem frequently occurs where minor children are named on the beneficiary designation form. Where you have minor children, your Will probably has (or certainly should have) contingent trust provisions that would create a trust for the minor children at your death. However, if your minor children are listed as the direct beneficiary, then the asset will not be a probate asset, and thus not available to fund the trust. Instead, it will pass to the children, though since they are minors, it will go into a conservatorship, and they will be entitled to the full amount at age 21, which is generally contrary to most estate planning clients’ wishes.

5. LONG TERM CARE POLICY.

I’m not suggesting running out and panic buying a long-term care policy like its toilet paper or hand sanitizer. However, if it’s something you’ve considered before (or even if not), you might want to look into one, more from the standpoint of planning for the future while you ARE healthy than in response to coronavirus fears.

It is statistically documented that 1/3 – 1/2 of all people will spend some amount of time in a nursing home or assisted living facility, and the likelihood increases with age. Studies have also found that the average nursing home stay is 2.4 years, citing data from the Centers for Disease Control and Prevention in Atlanta, Georgia. The national average for nursing home care for a private room is nearly $7,500 per month, or about $90,000 per year. The average costs in Georgia and Alabama generally range $5,500 – $6,500 per month.

Here is the added benefit of a LTC policy, if the need for assistance arises, and if between retirement income and the LTC policy you have enough monthly cash flow to private pay the monthly nursing home costs, there is no need to make transfers of assets as you will not even need Medicaid to cover the nursing home costs. Alternatively, as long as you have a LTC policy that would pay for five years, you could still transfer all your assets, let the LTC policy kick in, and after five years you are outside of the Medicaid lookback window! This allows you to put off any gratuitous transfer as long as possible until it becomes absolutely necessary.

6. REVIEW OF JOINT ACCOUNT DESIGNATIONS.

Frequently I have clients who come in and are pleased to tell me that they named their son, daughter, or whomever as a co-owner of their account, or as the POD (pay on death) beneficiary. In the client’s mind, they did this either because they thought it would make the probate process easier, or because they wanted someone to have access to pay their bills if they become incapacitated. Granted, that result can be accomplished by the change. But there are several potentially negative consequences. First, by doing this, the client has now converted the account to non-probate property. (For example, let’s say you have a $100,000 CD. You name one child as a co-owner or POD beneficiary — in your mind, so they can access it for your benefit if you become incompetent or pay for your funeral. You have 2 children, and your Will provides each share in your estate equally. Unfortunately, since this CD will pass by operation of law to the survivor or POD beneficiary on the account at your death, your other child will not share in it, unless the named child willingly gifts half of it to the sibling). Second, you have potentially made this an asset that a creditor of your child can pursue, even while you are alive, if your child is a co-owner. Third, if it’s a stock investment account, your action likely results in the child taking a lower basis at your death, meaning you have created the potential for capital gain tax where it would not have otherwise existed

7. POWER OF ATTORNEY AND HEALTH DIRECTIVES FOR YOUR CHILDREN.

Fortunately for children, they seem less at risk. However, now is an ideal time to put in place some necessary documents for them.

As parents, we always have our children’s best interests at the forefront of our minds. And we usually try to do anything we can for our children. However, many might take for granted the authority we have had as a parent for their first 18 years of life. How often have you called the bank on the student account or credit card they have that you set up late in high school? Or called their pediatrician to discuss an issue? Or gotten involved to assist with an issue with some financial transaction? And of course, there has never been any question of your authority in this regard, either with your child, or with whomever you have been dealing. You are, after all, the parent.

Once your child turns age 18, nothing changes,….except that everything changes. That is because once your child turns age 18 (19 in Alabama), it’s still “YOUR” child, but he or she is no longer “A” child. They are legally an adult. Legally, this cuts off virtually all of your rights on your child’s behalf.

This is particularly true under HIPAA laws and the privacy rules associated with the same. If your child has a medical emergency, especially if out of town, you are not only not in a position to make decisions for your child, you will not even be able to be provided information, at least until you get there in person, and even then, there is no assurance in this regard.

I recommend to every parent of college age children that there be in place a Power of Attorney and Advance Directive for healthcare for the child upon turning age 18, naming the parent(s) as the agent. This is all the more true with the current coronavirus pandemic.

8. HIGH NET WORTH ESTATE PLANNING.

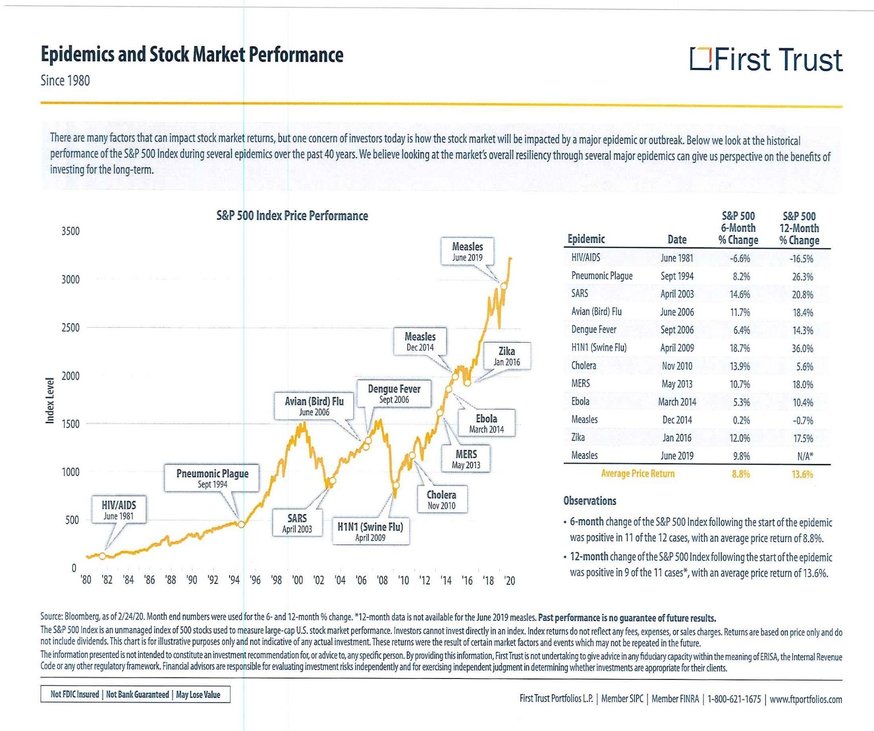

While we’ve all been troubled by the roughly 25% drop in the stock market in the last few weeks, what that means for the high net worth client concerned with estate taxes or interested in gifting is that there is no better time than right now to consider some significant gifting, trust planning and other advanced planning strategies using these depressed values, whether it is outright gifts, creation of GRATs, Family Partnerships, Trusts for children or grandchildren or other high net worth techniques. Consider the chart on the following page. Markets recover. The time for planning is now.

Find more detail on these and other estate planning topics at the Hall Booth Smith Life, Death and Taxes-estate planning Blog.

Leave a comment

You must be logged in to post a comment.